interest interview about the impact of facebook's ipo for start ups that are doing real research and development versus simple social media sites

http://www.theatlantic.com/business/archive/2012/05/the-golden-age-of-silicon-valley-is-over-and-were-dancing-on-its-grave/257401/

The Golden Age of Silicon Valley Is Over, and We're Dancing on its Grave'

MAY 18 2012, 2:59 PM ET 116

To help make sense of the Facebook IPO, we caught up with Steve Blank, a professor at Berkeley and Stanford and serial entrepreneur from Silicon Valley. This conversation has been edited and condensed.

THOMPSON: What does the Facebook IPO mean for Silicon Valley?

BLANK: I think it's the beginning of the end of the valley as we know it. Silicon Valley historically would invest in science, and technology, and, you know, actual silicon. If you were a good VC you could make $100 million. Now there's a new pattern created by two big ideas. First, for the first time ever, you have computer devices, mobile and tablet especially, in the hands of billions of people. Second is that we are moving all the social needs that we used to do face-to-face, and we're doing them on a computer.

And this trend has just begun. If you think Facebook is the end, ask MySpace. Art, entertainment, everything you can imagine in life is moving to computers. Companies like Facebook for the first time can get total markets approaching the entire population.

THOMPSON: That all sounds pretty good for Facebook, actually.

BLANK: For Facebook, it's spectacular. But Silicon Valley is screwed as we know it.

If I have a choice of investing in a blockbuster cancer drug that will pay me nothing for ten years, at best, whereas social media will go big in two years, what do you think I'm going to pick? If you're a VC firm, you're tossing out your life science division. All of that stuff is hard and the returns take forever. Look at social media. It's not hard, because of the two forces I just described, and the returns are quick.

THOMPSON: Half the tech and innovation world seems to think this is just evidence that we're in the middle of a dot-com remix. You disagree?

BLANK: In the last bubble, venture capitalists went into a frenzy if anything had an ear and eye. I don't think this a bubble. I think the valuations are a bit of a bubble, but social media is real.

THOMPSON: Is Facebook worth $100 billion?

BLANK: In the last bubble there were no customers. Facebook makes $4 per user. The users are customers. They produce real revenue. Nobody's debating whether Facebook can make money. They're debating how much more valuable Facebook's hundreds of millions of users can be, and how fast can they can grow that value. That's an execution problem.

THOMPSON: But you think Silicon Valley is screwed, whether Facebook lives up to that valuation or not. Why?

BLANK: I teach science and engineering. I see my students trying to commercialize really hard stuff. But the VCs are only going to be interested in chasing the billions on their smart phones. Thank God we have small business research grants from the federal government, otherwise the Chinese would just grab them.

THOMPSON: But there are some people doing interesting, daring things, like Vinod Khosla.

BLANK: He is. But think about this. The four most interesting projects in the last five years are Tesla, SpaceX, Google Driving, and Google Goggles. That is one individual, Elon Musk, and one company, Google, doing all four things that are truly Silicon Valley-class disruptive.

THOMPSON: Does this represent a large-scale failure among venture capitalists in the Valley?

BLANK: It's not like anybody is doing evil or bad. It's like what Willie Sutton said: Social media is just "where the money is."

THOMPSON: What's the fix?

BLANK: I don't know what the fix is. Thank God for federal government grants, and the NIH, and Musk, and Google.

THOMPSON: So is American innovation simply doomed, or is it more complicated than that?

BLANK: The headline for me here is that Facebook's success has the unintended consequence of leading to the demise of Silicon Valley as a place where investors take big risks on advanced science and tech that helps the world. The golden age of Silicon valley is over and we're dancing on its grave. On the other hand, Facebook is a great company. I feel bittersweet.

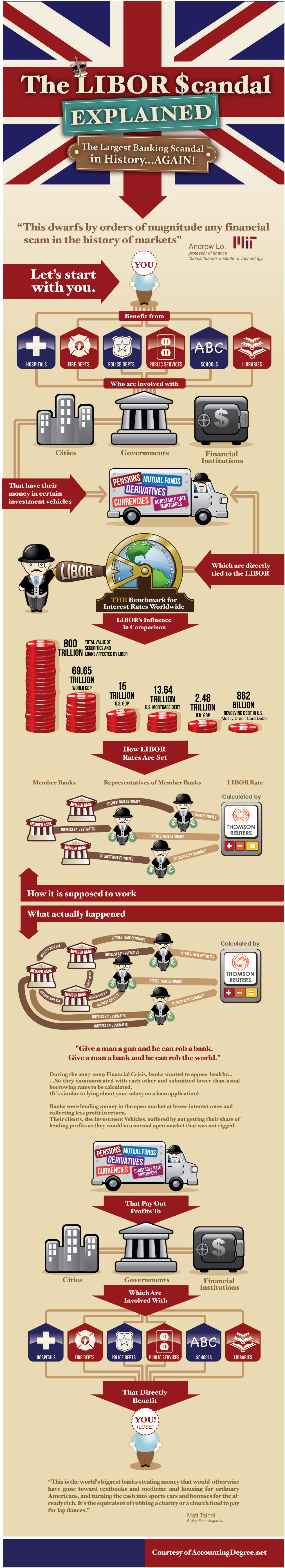

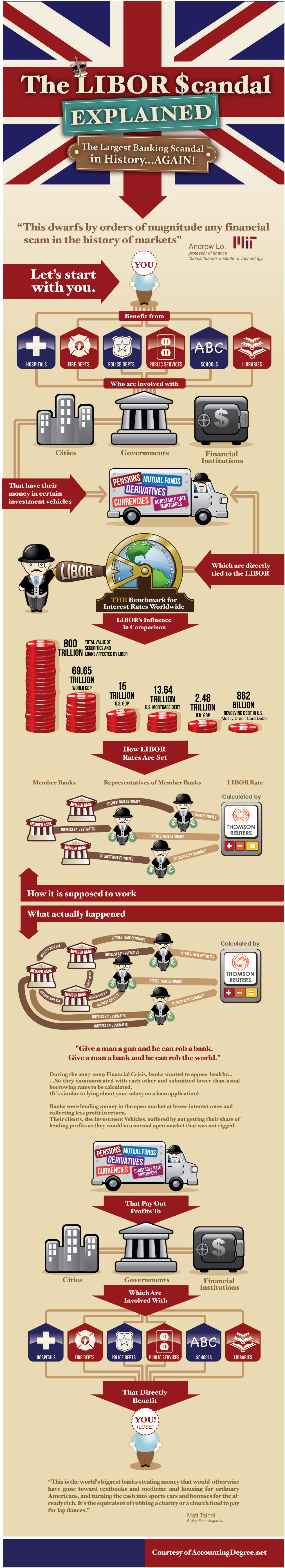

They note that the finance sector today produces a greater percentage of GDP than at any time in history. In the mid-nineteenth century, its contribution was between 1 percent and 2.5 percent of GDP. It peaked at around six percent of GDP at the beginning of the Great Depression, and then fell sharply. Since 1945 it has been steadily increasing, to 8.4 percent over the last two years.

They note that the finance sector today produces a greater percentage of GDP than at any time in history. In the mid-nineteenth century, its contribution was between 1 percent and 2.5 percent of GDP. It peaked at around six percent of GDP at the beginning of the Great Depression, and then fell sharply. Since 1945 it has been steadily increasing, to 8.4 percent over the last two years. When most sectors of the economy grow, new companies are created. The authors found, however, that the finance sector is not driving firm formation; it is cannibalizing entrepreneurship in the U.S. economy by offering wage and skill premiums to individuals who might otherwise have started companies. It is also causing far greater volatility among publicly traded firms and a reduction in the quality of businesses started.

When most sectors of the economy grow, new companies are created. The authors found, however, that the finance sector is not driving firm formation; it is cannibalizing entrepreneurship in the U.S. economy by offering wage and skill premiums to individuals who might otherwise have started companies. It is also causing far greater volatility among publicly traded firms and a reduction in the quality of businesses started.